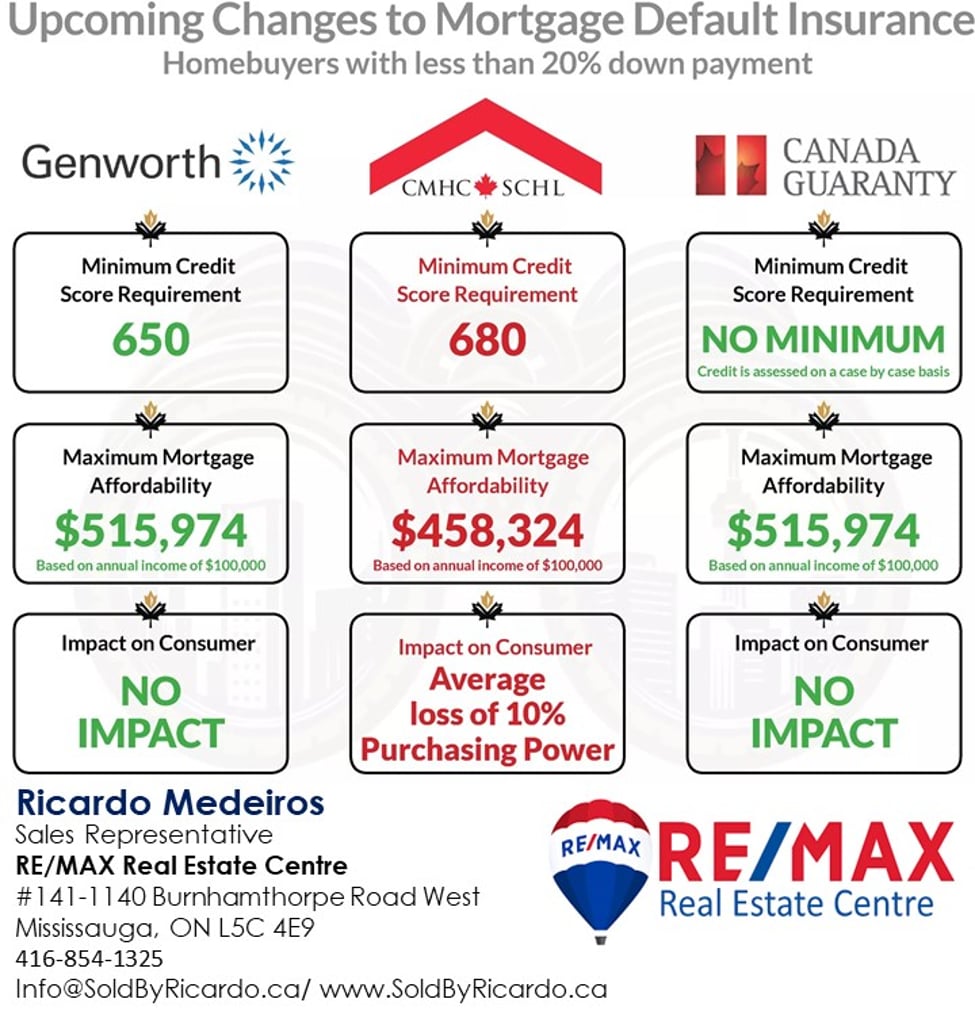

Over $50,000 DROP in purchasing power!Here's a table that illustrates how CMHC's proposed changes measure up to its competitors, Genworth and Canada Guaranty in the default insurer landscape.

It's amazing to know that consumers still have a choice in keeping homeownership within reach!Calculations based on:Household income of $100,000

Stress Test rate of 4.94%

Annual Property Taxes of $2,000

Monthly Heat Cost of $100

CMHC Qualifying GDS rate of 35%

Genworth and Canada Guaranty GDS rate of 39%

When preparing your home for sale, you need to fix things up, declutter, perhaps slap a fresh coat of paint on a few walls. That’s all part of getting your property ready for buyers.

But there’s another type of preparation that you also need to do. And, the sooner you do it, the less stressful your move will be.

You need to get all your paperwork together.

Here’s what to gather:

- Property documents such as deeds, easements, surveys, liens, etc.

- Mortgage documents, plus any other loans (i.e., line of credit) that use the property as collateral.

- Maintenance and service agreements that may continue with the new owners.

- Warranties and guarantees that are transferrable to the new owners.

- Recent utility bills, such as water, electricity, etc.

- Rentals (i.e., water heater rental.)

- Home security agreements and codes.

- Contracts for any work done on an ongoing basis. For example,

lawn maintenance.

Getting these records together early will ensure you’re not scrambling at the last minute to find them. Some of these documents, such as warranties, also make for attractive selling features.